How to Get a Merchant Cash Advance Blursoft. Pros & Cons.

Table Of Content

- 1 How to Get a Merchant Cash Advance Blursoft. Pros & Cons.

- 2 Introduction:

- 3 Getting Fast Business Financing with a Merchant Cash Advance Blursoft:

- 4 Advantages of using Blursoft for an MCA:

- 5 Potential Disadvantages:

- 6 How does Blursoft work?

- 7 MCA Case Study - Blursoft and XYZ Construction

- 8 Who is eligible for a Blursoft MCA?

- 9 How to apply for an MCA from Blursoft

- 10 What to expect after you apply for an MCA from Blursoft

- 11 Merchant Cash Advance Blursoft FAQ

- 12 Q: What is a Merchant Cash Advance?

- 13 Q: What is Blursoft?

- 14 Q: Who is eligible for a Blursoft MCA?

- 15 Q: What are the benefits of getting an MCA from Blursoft?

- 16 Q: What are the drawbacks of getting an MCA from Blursoft?

- 17 Q: How do I apply for an MCA from Blursoft?

- 18 Q: What happens after I apply for an MCA from Blursoft?

- 19 Conclusion

Introduction:

Getting Fast Business Financing with a Merchant Cash Advance Blursoft:

As a business owner, having access to quick capital can be critical for taking advantage of opportunities or overcoming cash flow challenges. Merchant cash advances (MCAs) are one financing option that provides fast access to funds by exchanging a lump sum of cash for a percentage of future credit card sales. Companies like Blursoft specialize in providing these types of advances.

Blursoft streamlines the process of securing an MCA. Their online application takes just minutes to complete and requires minimal documentation. Applicants receive a decision rapidly, often within 24 hours. Approved businesses gain access to the lump sum payment deposited directly into their bank account.

MCAs differ from traditional small business loans in a few key ways:

- No collateral is required. The MCA utilizes future sales as the repayment mechanism rather than assets. This helps businesses with limited assets or unfavorable credit histories.

- The application process is much faster, with funds being made available in days rather than weeks or months.

- Repayment occurs as a percentage of daily credit card sales, removing fixed monthly payment obligations. This repayment flexibility aligns the repayment amount with sales volumes.

While MCAs provide an influx of capital rapidly, it is wise to consider both advantages and disadvantages before obtaining one:

Advantages of using Blursoft for an MCA:

- There are a few key benefits that make merchant cash advances like those from Blursoft an attractive financing option for many small business owners:

- Speed – The application process is fast, with funding possible in as little as 24-48 hours in some cases. This rapid access to capital makes MCAs ideal for pressing capital needs.

- Flexibility – MCA repayments are structured as a percentage of daily credit card sales rather than fixed monthly payments. This aligns repayment amounts to match the ebbs and flows of sales volumes.

- Accessibility – MCA qualification depends more on sales history rather than credit scores, assets, and business longevity. This helps newer or distressed businesses access capital when traditional lending is difficult.

- No Collateral – MCAs do not require any business or personal assets to secure the advance. This removes collateral barriers to obtaining funds.

Besides the speed, flexibility, wide accessibility, and lack of collateral requirements, merchants’ cash advances also have simple applications that can be completed online or over the phone. Funds are sent directly to your business checking account via ACH transfer for fast access.

Potential Disadvantages:

- MCA rates and fees are generally higher than a bank loan

- Short repayment terms ranging from 6-24 months

- Repayment reduces future sales revenue by a fixed percentage

- It is challenging to qualify for other financing while MCA is in place

Overall, Blursoft MCAs offer a viable path to securing capital quickly for businesses unable to obtain traditional financing. Weighing the benefits and costs will help determine if it aligns with your needs. With Blursoft’s streamlined process, you can easily explore an MCA as an option and decide if it works for moving your business forward.

How does Blursoft work?

With a merchant cash advance, a company like Blursoft provides you with an upfront lump sum payment, which you are responsible for paying back through an agreed-upon percentage of your daily credit card sales.

For example, Blursoft may advance your business $50,000, which you would pay back by remitting 15% of your daily credit card sales back to them until the full $50,000 is repaid. The repayment period is generally between 6-24 months.

The exact amount advanced, the payback percentage, and the repayment term will vary based on factors like your time in business, sales volume, and credit profile.

MCA Case Study - Blursoft and XYZ Construction

To better understand how companies like Blursoft provide MCAs, consider this example of a construction company we’ll call XYZ Construction:

XYZ is a small commercial construction firm that has been in business for 3 years. They have been ramping up operations, but a recent materials cost overrun set them back on their cash reserves.

They have a pending medium-sized commercial project starting in 60 days but need $100,000 in upfront costs to mobilize equipment and the job site. Their assets are tied up in equipment, and as a newer firm they don’t have established lending relationships with any banks.

XYZ goes to Blursoft’s website and completes a short online MCA application, providing details on their business, sales history, owner background, and the amount they need.

Blursoft reviews the application and approves XYZ for a $100,000 MCA. The terms are repayment of 18% of daily credit card sales over an 18-month period.

XYZ accepts the terms, and Blursoft directly deposits the $100,000 lump sum payment within 48 hours.

Over the next 18 months, XYZ pays back the advance by sending 18% of their $5,000 average daily credit card sales, or $900 per day, back to Blursoft until the full $100,000 is repaid.

This MCA enabled XYZ to take on the critical job that propelled their business growth, something that would have been very difficult and time-consuming through traditional financing channels.

Who is eligible for a Blursoft MCA?

To qualify for a Blursoft MCA, you need to meet the following criteria:

- You must have been in business for at least 6 months

- You must have a minimum of $5,000 in monthly credit card sales

- You must have a valid business bank account.

- You must be at least 18 years old and a US citizen or permanent resident.

How to apply for an MCA from Blursoft

Applying for an MCA from Blursoft is easy and fast. Here are the steps you need to follow:

1. Go to the Blursoft website and click on “Apply Now”

2. Fill out the online form with some basic information about your business and your funding needs

3. Wait for one of our funding specialists to contact you and discuss the best MCA option for you.

4. Review and sign the agreement with the lending partner

5. Receive the cash in your bank account within 24 hours

What to expect after you apply for an MCA from Blursoft

After you receive the cash from the lending partner, you can immediately start using it for your business needs. You will also start repaying the MCA with a fixed percentage of your daily credit card sales. The repayment process is automatic and hassle-free. You do not need to worry about monthly bills or late fees. You can also track your balance and payments online through the Blursoft portal.

If you have any questions or concerns about your MCA, you can always contact our customer service team, who will gladly assist you.

Merchant Cash Advance Blursoft FAQ

Q: What is a Merchant Cash Advance?

A: A Merchant Cash Advance (MCA) is a type of alternative financing that provides businesses with quick access to cash12. In exchange for a lump sum payment, the business agrees to pay back the advance through a percentage of its future sales.

Q: What is Blursoft?

A: Blursoft is a leading provider of MCAs. They offer funding from $5,000 to $500,000 for a period of up to two years3.

Q: Who is eligible for a Blursoft MCA?

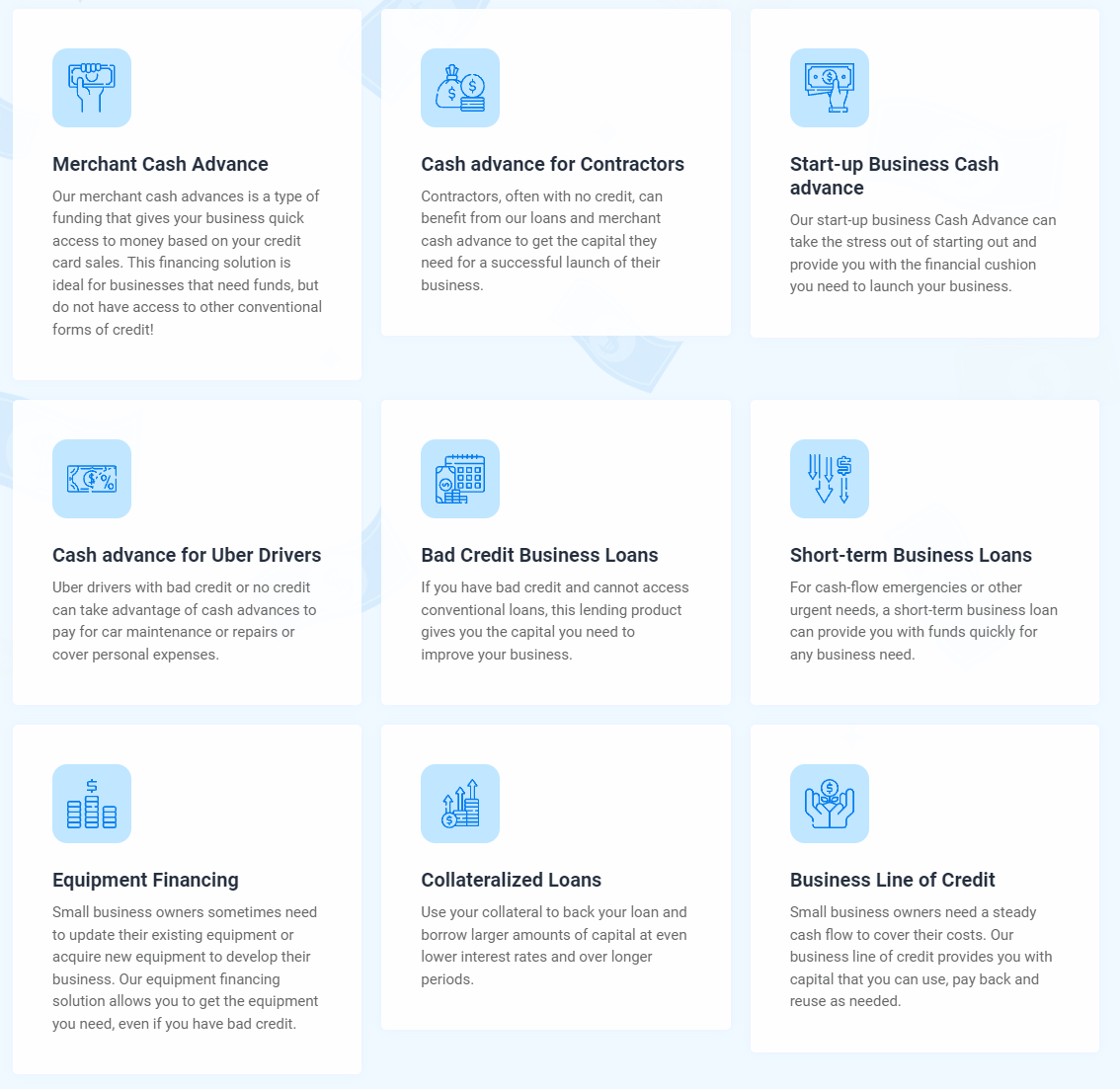

A: Small to medium business owners, startups, contractors, Uber drivers, and young entrepreneurs can benefit from a Blursoft MCA. Even if you have bad credit, you may still be eligible for an MCA from Blursoft.

Q: What are the benefits of getting an MCA from Blursoft?

A: Blursoft’s MCA program is flexible and can be tailored to meet your business’s specific needs. They offer quick access to cash and don’t require collateral or a lengthy approval process.

Q: What are the drawbacks of getting an MCA from Blursoft?

A: MCAs can be expensive and come with high fees and interest rates. It’s important to carefully consider whether an MCA is the right choice for your business.

Q: How do I apply for an MCA from Blursoft?

A: You can apply for an MCA from Blursoft by visiting their website and filling out an application form. You’ll need to provide some basic information about your business and its finances.

Q: What happens after I apply for an MCA from Blursoft?

A: After you submit your application, it will be reviewed by Blursoft’s underwriting team. If you’re approved, you’ll receive funding within 24 hours

Conclusion

A merchant cash advance from Blursoft can be a smart and convenient way to get fast and flexible funding for your small business. Whether you need money for working capital, equipment, hiring staff, or any other business expense, an MCA can help you achieve your goals.

However, before applying for an MCA from Blursoft, make sure you understand how it works, the pros and cons, and how to compare different offers. You should also avoid getting scammed by a shady MCA lender who might charge you hidden fees, misrepresent the terms, or harass you for repayment.

If you are ready to take your business to the next level, apply for an MCA from Blursoft today and get the cash you need in as little as 24 hours.